How soon should you get a CFO into your startup?

Recent research shows that the CFO role is significantly undervalued in all stages of the startup cycle, with only 1 in 3 venture-stage companies in the UK having a CFO. Our experience is that a strong, properly incentivized and aligned CFO can make a big difference to the performance of a company and the success of transactions. When is the optimal time to take the plunge and hire your CFO?

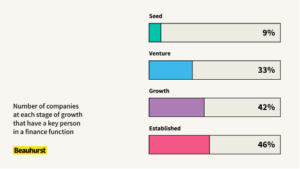

Let’s face it, it is unusual to see a CFO as a founder or co-founder in a startup, and indeed, according to the research from Beauhurst, less than 1 in 10 seed stage startups in the UK have a CFO. The reason is fairly obvious, CFOs (being financially prudent) need to be paid and a senior finance person is difficult to afford for a company that is bootstrapping or living on angel/friends & family funding.

It is quite surprising to note that less than 1 in 2 established startups (beyond growth stage) have a CFO function (as per the table above), given that affordability should not be the key issue at that stage, and the value that a CFO can bring.

A good CFO plays an important role in the business, helping the company to set and achieve its targets. They bring an overall understanding of the business translated into revenue and cost drivers, that others usually don’t have. Realistic financial targets can be balanced with key factors such as funding milestones. They can then help the team drive towards these targets, and help them to adjust strategies, such as pricing, product mix or go-to-market, along the way.

One of the best CFOs that I have encountered plays a key role in his company’s strategic business development and revenue generation. He uses capital raising as a business development tool, approaching the target’s M&A or Corporate Development team with an investment proposition. This frequently results in a discussion around synergies and the value of his company’s products to the target, which is then steered to the target’s relevant business unit and picked up by his business development team. An investment result is a bonus, as it cements the commercial relationship!

In order to capture the future value of your company in a transaction, particularly important with a high-growth tech company, the forward projections need to be modelled and a creditable reflection of the business going forward (and demonstrable from its past), which takes a deep understanding of the business from someone who lives with the business every day. Our most successful transactions have had CFOs in place.

It is essential for all transactions that the historical financials are in good order, with a good quality financial reporting track record over years, preferably with independently reviewed or audited financials. It is always difficult to go back and adjust previous year financials as you prepare for a transaction. In preparing for a transaction, the CFO would ensure that the financial position of the company is aligned with the transaction, such as balanced working capital, and a clean balance sheet.

It is particularly important to have a CFO in place when you are selling your company, that is aligned with getting the transaction done, and is representing the company (as opposed to the individual shareholders). During the transaction itself, It’s important to have a consistent voice (with a solid understanding of the business drivers and risks) when buyers are drilling down into the numbers and running scenarios.

It also does not help if the CFO is not motivated to get the transaction done, for example if they know that the transaction will result in their job loss without fair compensation, and may end up subverting the process. We have even seen cases where, particularly with part-time CFOs, there can be a conflict of interest in a transaction, where the CFO has a special relationship with an investor, buyer or advisor, and may try and steer a transaction in a particular way, and in the worst case end up “batting” for both the buyer and your company (as the seller).

A good CFO understands the business and plays a strategic role, helps guide the CEO on reaching the company’s financial goals and ultimately helps to keep the CEO honest. An ideal board configuration includes 2 executive directors, the CEO and CFO, which also enables the CFO to have a certain independence in reporting to the Board.

The CFO helps to build a company that has high standard of reporting and compliance year-on-year, which ultimately makes the company more valuable and saleable. We therefore recommend that you appoint a CFO as soon as your company can afford it, and this would be typically after your Series A (or first institutional round).