Would your tech company benefit from a PE buy-and-build play?

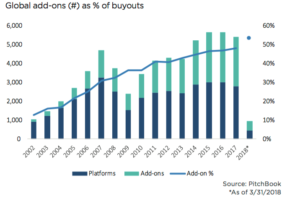

If a PE does a buyout of your tech company, there is a 50% chance that it will be as an add-on in a buy-and-build strategy (where the PE buys a company and then builds on that “platform” through add-on acquisitions), according to a recent PitchBook analyst’s report.

And according to a BCG study The Power of Buy and Build: How Private Equity Firms Fuel Next-Level Value Creation, buy-and-build deals generate an average IRR of 31.6% (from entry to exit), compared with 23.1% for standalone deals.

Generally, buy-and-build deals can both accelerate revenue growth and drive margin expansion by realizing synergies. Furthermore, buy-and-build strategies can create market expectations of continued growth and margin improvements in portfolio companies, which can translate into higher exit valuations.

Multiple expansion is the main engine of superior performance in buy-and-build. Leverage reduction, revenue growth, and widening margins, of course, contribute to higher returns. But their roles are secondary to multiple expansion, which in many cases is the result of increased expectations of profit growth, fueled in part by higher revenues or wider margins. The influence of buy-and-build on investors’ expectations, and hence on multiples, is underscored if we compare the multiple expansion of standalone deals with that of buy-and-build deals. The contribution of multiple expansion to the IRRs of buy-and-build deals was 15.3 percentage points, on average, compared with 7.5 percentage points in standalone deals.

Buy-and-build deals of small platforms outperform those of medium-sized and large platforms by sizable margins. The deals of the small platforms, defined as those with an enterprise value of less than $70 million, generated an average IRR of 52.4%, compared with 23.1% for standalone deals. The buy-and-build deals of large platforms—those with an enterprise value of more than $290 million—underperformed relative to both smaller platforms and standalone deals. (Medium-sized platforms had an enterprise value of $70 million to $290 million.)

Buy-and-build deals that involve cross-border add-on acquisitions outperform both standalone deals and deals involving domestic acquisitions, generating an average IRR of 38.2%, compared with 23.1% for standalone deals and 27.3% for domestic acquisitions.

Deals that take the platform company deeper into an industry generate an average IRR of 43.5%, compared with 16.4% for deals that diversify the business and 23.1% for standalone deals.

Deals that include one or two add-on acquisitions outperform both standalone deals and those that include more than two acquisitions. Deals in the BCG study with one or two add-ons generated an average IRR of 35.5%, compared with 23.1% for standalone deals and 19.9% for deals involving more than two add-ons.

Superior performance in buy-and-build deals is limited to industries that share specific characteristics, including low growth rates, low margins, and high fragmentation. The sectors that have exhibited a high % of add-ons over recent years (but not necessarily superior returns) is shown in the graph below.

Whether your tech company is to become the platform or an add-on, you would do well to consider these factors when contemplating the PE transaction. In general, however, being part of a buy-and-build play can provide superior returns for all parties.