Will our technopreneurs manage to raise or exit in 2024?

2024 is building up to be an interesting year given the conflicting indicators, particularly in VC capital supply and deployment, whilst exits for founders and VC’s rely on steady and strong stock markets and M&A activity.

Starting on the capital supply side of the equation; VC fundraising in the US hit a 6-year low in 2023, indeed the lowest amount raised since 2017 according to the Financial Times (FT) of 5 January. Certainly our meetings with VC’s in the US, UK, Europe and Africa support this view; the environment to raise new VC funds has been difficult.

However, the FT article of 12 December read “The private capital industry’s ‘dry powder’ has hit $4 trillion”! Wow, that is a lot of cash! As that article points out, that money would buy every listed company on the London Stock Exchange but, more importantly, the number contrasts with $13 trillion of assets under management in the entire private capital industry – 25%.

Although if one considers that the available committed capital (dry powder) is clearly not being deployed, that would make sense. Those funds that have deployed capital and are now seeking new investment are finding the environment hard, but those which have sat back to watch how the economy pans out have buying opportunities, although timing pressure to achieve returns is building.

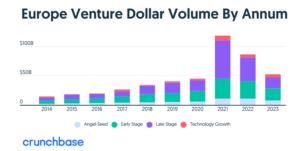

A bright spot in the industry is from the UK where HSBC Innovation Banking and Dealroom reports that UK startups raised $21.3 Bn, the third highest year after 2021 and 2022. This is in line with the European capital raising YoY trend which is steadily upward if you disregard 2021 and 2022 as outliers.

On the exit side, we see some more interesting facts; global stock markets recorded their strongest year since 2019 following a late rally towards the 2023 year end. Share price growth drove the global MCSI index to grow some 20%, largely driven by expectations of falling borrowing costs and bond yields, attracting investors to equity returns.

If we expected this rally to translate into M&A activity, however, we would be wrong – the London Stock Exchange Group released data showing that $2.9 trillion was deployed in global M&A transactions in 2023, down 17% from 2022, which was down from 2021.

What does all of this mean for technopreneurs? We are optimistic that 2024 will pick up pace again, particularly on the smaller end as VC’s anticipate a recovering (if risky) global economy and lower interest rates. These rates are going to be more stable, but at higher levels than those of the past decade, according to Professor Joe Nellis CBE from my alma mater, Cranfield School of Management and Cranfield Executive Development. But if the message of “dry powder” is right, there will also be pressure to deploy private capital as funds run out of time.

So we remain optimistic that the VC environment remains strong with many more excellent, seasoned professional fund managers taking different strategies; thereby allowing differentiation, to enable technopreneurs to find the right “home”.

This does make the fund raising exercise more complex and lengthy but increases the importance of advisors in finding this “home”. Just because five fund managers have said “no” does not mean that the business is a poor one. It means that the investor with a similar outlook is not yet on the cap table.