Technopreneurs, beware of “dead shareholding”

Potential investors see a red flag when the shareholding of the active founders/management is too low. This becomes even more difficult when it is as a result of dead shareholding.

Investors will ask a filtering question early on in their evaluation process around the cap table. Their main objective is to ensure that the people driving the success of the company are adequately incentivized. A good rule of thumb is that there should be at least 50% active founder/management shareholding going into a Series A, bearing in mind that there would normally be subsequent rounds, with further dilution on the cards, all going well.

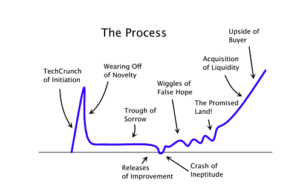

This incentivization issue is very real, and not theoretical, in our experience. We have, all too often, heard founders privately debate whether it is worth continuing the journey of their startup – and this is almost always with founders with low shareholding experiencing challenges or headwinds, or going through the Trough of Sorrow – which is normal in the evolution of a startup. (As per Paul Graham’s process featuring the Trough of Sorrow. Image Credits Andrew Chen)

Investors are right to be concerned, as it probably means that the startup will never live up to its potential. The founder will end up either leaving or trying to arrange a sub-optimal sale of the company. And we don’t often see stellar performances when professional managers are installed to drive early stage companies.

How do startups get into this cap table situation in the first place. In my mind, there are two early stage scenarios:

- Too much shareholding is given away in Pre-Seed or Seed rounds for relatively small amounts of money. This is as a result of inexperience by both the founder and the investors (often friends and family), as it is clearly not good for the future evolution of the company and hence the shareholders

- One or more of the founders decide they are going to leave the company, and take some or all of their shareholding with them, resulting in dead shareholding

Investors consider dead shareholding to be shareholding that is not held by either investors or active founders/management. Dead shareholding would include that of a founder that is no longer an executive but is playing a non-executive role on the Board.

The problem with dead shareholding is that is not available to incentivize performance, and can even put the startup at a competitive disadvantage relative to its peers. Dead shareholding therefore compounds the problem of low active founder/management shareholding.

We mostly see early stage startups without institutional investors having very unsophisticated or even no shareholders agreements, which is a recipe for dead shareholding, if one or more founders walk. Once institutional shareholders come in, they would normally negotiate a new shareholders agreement as a condition to investing, which would include clauses to handle the situation where founders leave the company prematurely.

A founder vesting clause can protect the company and the shareholders (including the remaining founders) from dead shareholding. We have heard founders react when presented with this clause with “we have this shareholding already, why does it now need to vest?” but eventually understand the protection that it provides.

In fact repeat entrepreneurs are looking to even increase the vesting period, from the current “standard” of 4 years, to up to 8 years, according to the recent TechCrunch article 4-year founder vesting is dead, understanding that the journey to exit can easily take that long, if it goes all the way. They also understand that it is not only about preserving the quantum of their own shareholding, but about protecting the value of their startup and thus their shareholding through mitigating the dead shareholding issue.

Therefore technopreneurs should take the easy steps early on to prevent dead shareholding, as a leaving founder can seriously compromise the investability of their startup, and it being very hard to fix later.