How blockchain is transforming FX and cross-border payments

We foresee a world of blockchain-enabled next-generation payment platforms outside of the SWIFT network, with businesses being able to move money globally, trading in both fiat and digital currencies, accepting payments in digital currencies and integrating digital currencies into products and services. These advancements will continue to meet risk tolerances while enabling faster, cheaper, and more useful FX and payment transactions. Here is how it is happening.

Global businesses and consumer demand for cross-border payments are surging, expected to reach $290 trillion by 2030. Once considered ancillary to business operations, payments are now key levers for driving efficiency and growth. However, the legacy banking infrastructure that moves money globally lacks speed, pricing and flexibility, essential factors for effective cross-border transactions.

Blockchains, a specific form of Distributed ledger technology (DLT), can help businesses overcome significant pain points in sending and receiving cross-border payments by providing the rails for direct connections between parties. Blockchains, such as Hyperledger, Ripple and Ethereum, are being applied to FX and cross-border payments, each with its own protocol but are also interoperable, enabling direct connections.

Stablecoins, a form of DLT-based cryptocurrency, as discussed in our previous article, are often used as the digital currency of choice for transferring value across the blockchain rails due to their stable value, mitigating the risk of price fluctuations commonly associated with other cryptocurrencies.

Unlike traditional banking infrastructure, blockchain payments enable direct transactions between parties, such as peer-to-peer, business-to-business or bank-to-bank, using standardised data formats and protocols, regardless of location.

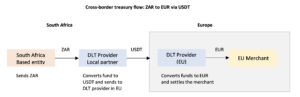

Businesses can harness DLT technology for many use-cases such as cross-border settlements, repatriating funds from emerging markets, and processing e-commerce transactions. These are two very common use cases in business.

- Treasury management: Companies’ treasury departments often need to transfer funds across their organization to meet operational and regulatory liquidity requirements. Blockchain speeds up intra-organizational fund transfers, especially across borders, and stablecoins like USDT or USDC ease liquidity challenges from emerging markets

- Supply chain payments: Blockchain technology streamlines supply chain payments, enabling swift and efficient payments to global suppliers and partners, reducing delays and potential disputes

The following illustrates a method for converting fiat funds to another fiat currency when international businesses utilise blockchain-enabled cross-border settlement methods with stablecoins.

- The originating company’s corporate treasury, opens an account with the fintech platform.

- The company requests a cross-border fund transfer between entities in different countries

- The platform directs the company to deposit funds with a partner bank in the originating country (at local bank transfer cost and speed)

- The partner bank converts funds to a stablecoin, such as USDT, and transfers to the platform (at minimal cost and almost instantaneous)

- The fintech platform converts the stablecoin to the recipient country’s fiat currency and deposits it into the customer’s bank account or platform wallet (at local bank transfer cost and speed)

Businesses face risks when adopting blockchain due to the regulatory infancy and unfamiliarity with blockchain concepts. Fintech firms play a crucial role in guiding businesses through this transition, offering expertise and focus to streamline blockchain adoption, reducing complexity, and risk. Working with a regulated partner allows a business to avoid the fixed costs of in-house development, while also offering the flexibility to hold volatile assets off business balance sheet and transferring regulatory compliance responsibilities.

Integrating blockchain for FX and payments might be a gradual process, one use case at a time. Select a strategy aligned with your current business and customer requirements. For instance, a business might opt to incorporate digital/cryptocurrency at the checkout, settling automatically in fiat currency to ensure the cryptocurrency never impacts your balance sheet, while ensuring optimal customer experience. If the aim is to implement blockchain across various applications, including trading and payments, ensure you choose the appropriate partner capable of providing a wide range of capabilities.

We are entering a phase of collaboration and coexistence between traditional financial institutions and blockchain-enabling fintech providers. Incumbents like Wells Fargo and HSBC are collaborating, utilising a shared distributed ledger technology (DLT) to facilitate transactions in U.S. dollars, Canadian dollars, British pounds sterling, and Euros.

The blockchain’s deepening impact on the payments and foreign exchange markets is particularly noteworthy, swiftly establishing its role as an integral part of the global payment’s infrastructure. We see that this will become particularly prevalent with hard currency stable coins mitigating risks of unstable emerging market currencies. As financial institutions and customers increasingly adopt blockchain, alongside maturing regulations, and innovations enhancing speed and scalability, we believe that blockchain in cross-border payments is here to stay.