Embedded insurance: A huge opportunity for Insurtechnopreneurs

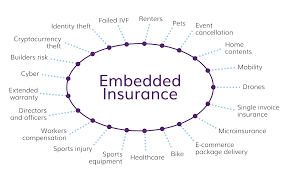

Embedded insurance is a feature of a product rather than a separate offering, usually sold by a non-traditional distributor at point of sale. This is a potential game changer, given that insurance is traditionally a grudge purchase “sold and not bought”. It can apply to almost every form of insurance and is potentially a huge market, but is still in its infancy. But where is the opportunity for Insurtechnopreneurs?

According to Chubb*, the market can grow to a GWP of $700 bn by 2025 in P&C alone.

Indeed, embedded insurance is not a new concept. “Free” funeral insurance offered by certain banks in South Africa on current account holders has been a gold mine for those banks. AppleCare has long been an (optional) feature and selling point – effectively an extended warranty sold with Apple products. I recall that when my first iPhone 3 battery died I took it into the Apple store in Covent Garden, concerned that one wasn’t able to replace the battery. Instead, I found that they replaced the whole phone!

A nice example is the ZhongAn phone insurance, which is literally embedded in a phone – if you were to drop the phone and the screen cracked, before you picked the phone up there would be a new phone on its way to you, triggered by the internal sensors which detect the accident.

A rather well known embedded offering in the health and life market in Europe and South Africa is Discovery’s Vitality programme which has built an enviable data set around the impact of behaviour on health and life risks. The complexity has been legislation around healthcare which limits the “reward” of cheaper insurance. This form of embedded insurance uses incentives such as “free” gym membership or Apple Watches to promote good behaviour, rather than reducing the premiums. What is really interesting is that traditional models of carriers can still be disrupted in spite of legislative constraints.

Key to the success of such a strategy is being able to control risks and if you’re the product provider (OEM), one would assume that it would be easier to build an attractive offering around the life time value of the product due to its reliability, rather than to try and control the claims ratio by putting in untenable conditions. Certainly, the OEM is in control of costs of warranty claims, which reduces the effective cost of the claim and therefore increases the overall margin.

Chubb has taken an interesting approach to the topic, by providing a platform called Chubb Studio, which provides its partners in retail, mobile phone and travel (as a start) with a platform to offer embedded insurance within their products.

Similarly, there are Insurtechs that provide their own end-to-end embedded insurance through partners (and are not platforms), often in specialist insurance categories. UK-based Anansi provides an automated end-to-end specialist goods-in-transit insurance through its API and partners.

Belgium-based Qover provides specialist “insurance as a service” through non-traditional partners in cycling, automotive & mobility, neobanking and the gig economy. They provide an end-to-end insurance offering including claims and regulatory compliance for 32 European countries.

On the other hand, there are independent platforms to enable insurers to offer embedded insurance through various partners such as OEMS, retailers and telcos, such as such as South-African based Root and Click2Sure . Root’s platform plugs into digital platforms, websites and apps, embedding a policy and enabling sales within a few days, together with policy documents, regulatory approvals, claims and operational processes across multiple regions.

I mentioned that embedded insurance is in its infancy. Tesla is showing the rest of the motor industry the way with embedded insurance based on its rich vehicle and driver data. One can imagine the entire industry moving this way in our autonomous vehicle future, where there is no driver risk, only the risk of faulty products – that is: embedded extended warranty insurance!

* Alex Lazarouw “Embedded Insurance – Where are we now?” Forbes Magazine